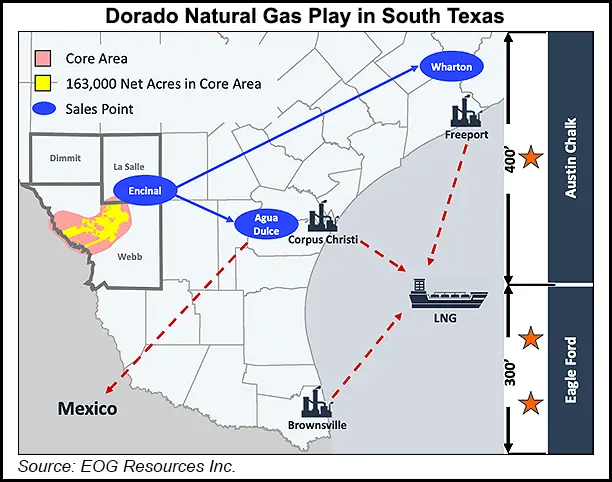

The Dorado, a stacked play in South Texas where EOG Resources Inc. has amassed a 163,000 net acre leasehold, may be a lock to build the Houston independent’s natural gas market credentials, the executive team said Friday.

The Dorado, a stacked play in South Texas where EOG Resources Inc. has amassed a 163,000 net acre leasehold, may be a lock to build the Houston independent’s natural gas market credentials, the executive team said Friday.

Dorado

The formation, which runs through the Austin Chalk and Eagle Ford Shale, has an estimated 21 Tcf net resource potential and is “highly competitive” with EOG’s oil inventory, according to the management team.

The Houston-based executive team shared results from the fourth quarter and a look ahead during a quarterly conference call. CEO Bill Thomas pointed to solid quarterly results across the board, that came during a dire year for the energy sector.

“EOG made significant improvements to its operating performance during 2020, across every area of the company,” Thomas said. “The benefits of these improvements are reflected in our fourth quarter results, and have created strong momentum as we set out to drive even better performance in 2021.”

EOG generated $666 million of free cash flow in 4Q2020, with capital expenditures (capex) 6% below the guidance midpoint. Per-unit cash operating costs fell 11% below the guidance midpoint.

“We implemented countless innovations across the company in 2020 that sustainably reduced well costs and operating costs. We also made progress on a number of new exploration plays with the objective of increasing capital efficiency and returns while lowering the production decline rate.”

Leaning On Oil

While Lower 48 oil prospects will continue to headline going forward, particularly in the Permian Basin, Eagle Ford and Powder River Basin (PRB), the gilded Dorado discovery announced late last year has compelling value, with an estimated 1,250 net drilling locations on the table.

EOG to date has drilled 17 gas wells to delineate the play, within earshot of transport corridors to Mexico and liquefied natural gas (LNG) exports overseas.

EOG management broke down the cost breakevens for Dorado, providing the comparative finding costs, lease/well costs, gathering/transportation, production taxes and the local price differential.

Based on EOG data, gas developed in the Dorado Austin Chalk averages $1.22/Mcf at Henry Hub, while the breakeven in the Dorado Eagle Ford is $1.24.

Management said the comparable breakevens put Dorado lower than the two biggest standalone gas formations in the country. EOG estimated the breakeven for gas is $1.33 in the Haynesville Shale and $1.55 in the northeastern portion of the Marcellus Shale. The Haynesville and Marcellus breakeven prices were sourced from company filings, industry reports and an EOG analysis.

Notably, while wellhead oil and condensate volumes fell in 4Q2020 from a year earlier to 444,800 b/d from 468,900 b/d, they were up 18% sequentially. EOG shut in some oil wells last year as prices fell, reducing volumes by 25,000 b/d. Volumes overall were 10% lower than in 2019.

For the year, natural gas liquids volumes increased 1% while natural gas volumes fell 8% to 1.29 Bcf/d, contributing to an 8% decline overall in total company production.

Lease and well costs, however, helped offset losses, falling 16% on a per-unit basis from 2019 to average $3.85/boe. The reduction in costs was the largest contributor to the overall 4% cut in per‐unit cash operating costs.

This year capex is set at $3.7-4.1 billion. That compares with 2020 spending, before acquisitions, of $3.5 billion, which was down 44% from 2019.

The 2021 capex plan is designed to maintain oil production at the 4Q2020 rate of 434,000-446,000 b/d.

The budget also is designed to fund a growing exploration inventory. However, even if commodity prices were to improve, don’t look for EOG to boost spending or build volumes, Thomas said.

Double The Premium

The focus instead is centered around “double-premium” oil and gas potential, with wells needing a minimum 60% after tax real rate of return, i.e. ATROR. That would be an average flat $40/bbl West Texas Intermediate oil price and $2.50/Mcf Henry Hub natural gas.

About 500 net wells are scheduled for completion this year, nearly all in the Permian Basin’s Delaware sub-basin, as well as the Eagle Ford and Powder River Basin. In addition EOG is “accelerating leasing and testing of numerous high‐impact exploration projects,” such as Dorado, while funding international efforts and various environmental programs.

“The 2021 capital plan is consistent with the strategy we have followed over the last year of not growing production in an oversupplied market,” Thomas said. “We are focused on increasing returns, generating free cash flow and maintaining our productive capacity while the oil market rebalances.

“In addition, we continue to invest in infrastructure to support reliable, safe, low-cost and low-emissions operations. With the improvements we have made in our operations and the size and quality of our premium inventory, we can now focus our capital allocation on the top half of our premium inventory – wells that are double‐premium or better.”

On the environmental front, EOG is striving to achieve zero “routine” natural gas flaring from its operations by 2025, and by 2040 it aims to have net zero direct and indirect company emissions (Scope 1 and 2).

“We are aiming to capture 99.8% of wellhead gas in 2021, and our goal is to eliminate routine flaring by 2025,” Thomas said. “We also keep raising the bar on water management, procuring more of our water from reuse sources every year. These efforts both reduce our environmental footprint and lower our costs.

“In the long run, our environmental ambitions are as bold as the rest of our operations. We have made significant progress the past several years, applying innovation and technology through our decentralized culture to reduce our emissions intensity.”

Net profits in 4Q2020 were $337 million (58 cents/share), versus year-ago profits of $637 million ($1.10). In 2020 losses totaled $605 million (minus $1.04), compared with 2019 profits of $2.7 billion ($4.71).