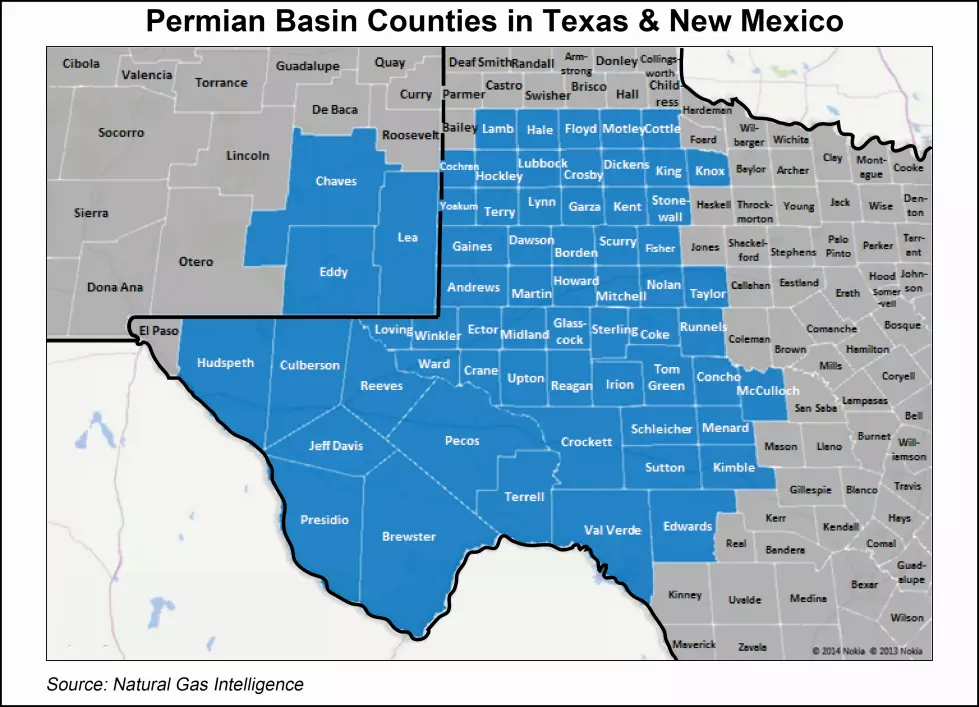

Nowhere are completions climbing faster than in the Permian Basin, analysts said. The data is borne out by the rising rig count in West Texas and southeastern New Mexico.

Nowhere are completions climbing faster than in the Permian Basin, analysts said. The data is borne out by the rising rig count in West Texas and southeastern New Mexico.

The number of wells completed in the Permian between January and March “exceeded the required output maintenance level, so oil production is set to rise in the current quarter, but will likely slow again later in the year,” analysts said.

“The Permian was disproportionately hit by the Texas winter crisis in February, and activity in the region grew significantly in March,” said Rystad’s Artem Abramov, head of shale research. “We have already detected 429 started fracture operations in March, while February 2021 ended up at 260 wells.

“Permian oil production maintenance currently requires about 300 unconventional well completions per month, so the basin is set for production growth already in the second quarter.”

By reviewing weekly fracturing jobs, the recent Permian rates “are now trending downwards from March’s impressive recovery numbers,” Abramov said.

“The two-week average fracture count has dropped from over 100 in mid-March to 65 currently, which is below the production maintenance level. If this trend continues, the Permian production recovery in the second quarter might not be long lasting.”

In the other oily production regions of North America, monthly fracture activity has been fluctuating each month since last October from 200-230 wells. The trend has not changed, according to Rystad. The two-week average fracture count grew to 63 in week 13 from 51 during week 12.

An estimated 967 total fracturing jobs were begun in North America during March, but with incomplete satellite data, the total may be around 100 more based on the running rate of activity. That could bring the final fracture count for March to about 1,064 wells, exceeding the January activity level by about 6.5%.

“Nearly all major basins are positioned for at least production maintenance in the second quarter of the year, or even some sequential production growth, as is the case with the Permian,” according to analysts.

The only exceptions were the Bakken Shale and Anadarko Basin, “where operators may still struggle to cope with the base decline” during the first quarter. In addition, the March fracture count for the Niobrara formation “may be overestimated. The growth in Colorado fracturing activity “is real,” but the current value is driven by detecting activity on several large pads, which could be spread out during March and April.

Illuminating Statistics

Based on natural gas production data through January, the Rystad team also has concluded that wellhead flaring fell sequentially in the major U.S. liquids plays, including the Bakken, Eagle Ford Shale and Permian.

“We have seen structural declines in gas flaring since early the fourth quarter of 2020, despite a significant recovery in fracture activity,” Abramov said. “This trend emphasizes the industry’s commitment to gradually eliminate routine flaring and develop tight oil resources in an environmentally responsible manner.”

As of January, “only 5.7% of gas was flared in the Bakken, whereas Permian flaring intensity fell to 1%, the same intensity as in the Eagle Ford regions, which historically have flared much lower shares of gas than the Permian.”

When February data is published, analysts expect to see a “temporary increase in Permian gas flaring as satellite data reveals a clear spike during the period of winter crisis” across Texas. “Yet it appears that gas flaring declined again in March in both the Permian and the Bakken, and we will most likely see a reported flared gas volume for March similar to the January level.”

Even with the temporary increase anticipated in February, Permian gas flaring from upstream and midstream operations likely declined to 270 MMcf/d in 1Q2021 from 300 MMcf/d in the fourth quarter. That would be the lowest level since 2017.

The Texas Independent Producers and Royalty Owners Association in March reported that between 2011 and 2019, methane emissions intensity fell by 77% in the Permian.

Permian flaring is not falling evenly across the Texas and New Mexico sub-basins, however.

On the Texas portion of the Permian, all of the formations “are seeing sequential declines in wellhead gas flaring.” However, in New Mexico’s portion of the Delaware sub-basin, aka the Delaware North, there has been a “modest increase,” to 45 MMcf/d from 43 MMcf/d.

“In fact, gas flaring in the Delaware North has gradually risen since 2020’s second quarter as activity and production levels on the Permian’s New Mexico side have remained exceptionally robust,” analysts noted.

Some of the public Permian operators may be more quickly embracing environmental, social and governance (ESG) initiatives too, which could account for the dips in flaring, according to Rystad.

For example, private Permian exploration and production (E&P) companies accounted for around 25% of gross gas production in the last half of 2020. However, those private E&Ps were responsible for 55% of wellhead gas flaring, according to Rystad.

“This implies that the average private operator has three to four times higher flaring intensity in the Permian than its public peers,” analysts said. “As public producers have gradually switched to more disciplined capital programs and introduced structural changes to their gas flaring policies, they have reduced their contribution to basin-wide gas flaring from 70% in early 2018 to 45% in the second part of 2020, while their share of basin-wide gross gas production was relatively unchanged.”

Source: https://www.naturalgasintel.com/permian-leads-oil-gas-well-completions-to-pre-pandemic-levels/